GIC Tsunami |

|

What would happen if one person, from each of the roughly 100 million households in the United States of America, went out and bought a one-ounce equivalent gold coin, tomorrow? The government could easily satisfy that demand, but at the cost of 1/3 of its official reserves, assuming a $300 an ounce gold price… "Sure, ya wanitt, here have it!" Yikes, run, I was just kidding? It was a fake bid? Nope. It would be a steal. The lending rates for bullion are rapidly approaching the market yield on US Government money, meaning that the gap between what the market will bear for each additional unit of gold relative to each additional dollar is closing, fast. This is bad for the dollar, but it is worse for long bond yields, especially if that's where gold sellers, hedgers, and borrowers are vested… oops!

Nevertheless, despite the reality that that kind of buy order could probably not be filled in one day, would you believe that it could push the government to the brink of bankruptcy? Well, after the banking system dissolves anyway. Remember that US dollar policy was born of a gold standard. It is a political alternative to the anchor, which a gold standard provided to us as security against the debauchery of our savings by a rogue government. Thus, it is not only an enemy of gold, but also a dangerous one, for the politics of the dollar have accumulated an extraordinary entanglement of hidden inflationary imbalances, over the years. Considerable wealth redistribution is underway and it is about to become visible, we believe. But what a different world it is today. We actually cheer this rogue government on. "Lower the rate for Reichmarks!" You see, it doesn't matter if we do it or someone else does it, the point is, do you want to have your savings vulnerable to the kind of perverse confidence game, where so long as no one else sells, it will all be fine? That's what is going on today. Time to become conscious of it because someone we think we trust is changing the balance of objective value. And the incentive to sell out, which up until now had been low enough to keep most participants honest, is on the rise. As incredible as this may sound, it is fact not fiction. So let's stop talking about whether there is any motive to keep you out of the gold buying business. Forget about the win that was "awarded" in September 1999. That was a gift. It's time for Gold bulls to take their own victory! Going too far?? Do you have any idea how far they have gone?

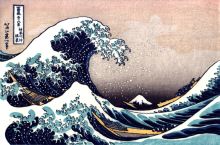

What breaks a tsunami? Islands can, like Japan in 1993. But Japan is in the process of breaking another tsunami, a financial one, and one that originated in US financial markets… let's not get that wrong. If this were a normal business cycle, it would have been over by now. But it is not. The big one is still coming, fast, and as of yet largely unnoticed. It has nothing to do with faith, or lack of it, nor has it anything to do with whether we are optimistic or pessimistic. It is only our simple contention that the Fed/Treasury are about to lose their two most powerful confidence tools.

Not even slick Bill Clinton will be able to keep this wave from biting him right in the ass… though as I write that, why do I visualize him grabbing for his surfboard? And why does it say "property of the Whitehouse" on it…

Topics for this week's GIC:

We are past disappointing profits and a deteriorating economy. The FOMC said as much in its brief statement yesterday (below). Our focus is now on the government accounts and the bond market. Read on.

Sincerely, |

||||||||||