Daily

Gold Market Outlook

Daily

Gold Market Outlook

The Big Bang

12 July 2004

a currency & gold market analysis

by Ed Bugos

| Print Copy | ||

| Today's Highlights: | ||

| Gold, the epitome of property |  |

|

| The Fed's inflation trap, not liquidity trap | ||

| USd technicals, news deteriorate further | ||

| COT's reveal bullish underlying structure | ||

| Bulls eat through resistance, charts look set | ||

| Calling on new suiters - IAG, GSS, GOLD | ||

| Gold share internals look up, our favorite bets | ||

The reason most people cannot fathom the extent of the State's hindrance of human achievement is because most people don't try to succeed.

Dare I call it an aphorism? Here's another:

If man (or woman) did not own his own person, he could neither be free nor own property; if he were neither productive nor capable of reason, property could not be. For, property is an extension of human reason and the natural product of its "free" labor - no such concept exists elsewhere in nature except wherever humans coexist.

So that's the sum of my thoughts after reviewing the history of 18th century Liberalism - liberal meant something different back then.

Forgive the brief philosophical excursion but I'll connect it to gold soon enough. By the way, the reason it's difficult staying away from politics, especially in gold, is because politicians increasingly bud their noses into the market's business.

The economy is none of their business. We should be regulating them…

Gold, the Epitome of Property

Liberalism was a social program, or movement, whose roots are traced back

to the English Revolution (the Civil Wars of 1640-60), during which time,

a radical Libertarian group headed by the Levellers established the principles

that were later to be credited for anticipating "the philosophical

ideas of the American Revolution" (Encyclopedia).

History has it as such: The philosophy had three principal tenets: the existence of certain inalterable rights of man beyond the jurisdiction of any government; the idea that governmental authority derived from the people; and the doctrine of separation of powers, directed especially against the contention "that the Law makers should be Law executors" - Encarta

The French revolution (1789-1799) was also a product of this uniquely Western movement, which swept through Europe, advanced by the works of people like John Locke, Lord Acton, Bastiat, Ben Franklin, Thomas Jefferson - and later by other US Presidents (I'm certain I've missed other important names too).

The byproduct of this movement - indeed the economic policy of Liberalism - was the system of voluntary exchange (and the industrial revolution) that the Marxists later labeled "capitalism."

Alas, there can be little doubt that it was this very libertarian movement - the big bang if you will - that was responsible for the spreading of capitalism, since after all, it never quite existed in China before the turn of the 20th century except briefly through trade with the west, which was later restricted too.

Anyhow, the basic tenet of economic freedom is property - that is, the philosophy of the "natural" relationship between individuals and the material world around them… specifically their natural rights to the product of their own labor. And the basic advantage of free (voluntary) exchange - or capitalism - is that both parties benefit from partaking in transactions involving their own property.

Although the movement died shortly after the revolution in England, and not long after the one in France, it remained entrenched in America up until about the middle of the 19th century, according to several authors, when it was overrun by what Rothbard (Austrian School) has dubbed the "progressive era."

The Austrians contend that since then the conservative totalitarian philosophies had been reinvented to squash the movement, deliberately; and have succeeded in cartelizing and monopolizing one industry after another - including labor - in creating whole classes of people to arbitrarily rob and regulate the rest, in sustaining the welfare/warfare state, and in their general encroachment on commercial / individual freedoms, or property rights.

It's no coincidence that the roots of the current Federal Reserve System then, as well as other big business-like cartels, can be traced back to the mid 19th century (in the Fed's case, the establishment of the National Bank Act by Secretary Salmon Chase prior to the Civil War). For, the Fed is but a legal tender monopoly.

If the object is to sustain inflation (a form of hidden taxation - confiscation of property without consent), you need a central bank; if the object is to have sound and just money, central banking must be abolished.

"The real obstacle in the way of an unlimited extension of the issue of fiduciary media is not constituted by legislative restrictions of the note issue, which after all, only affects a certain kind of fiduciary medium, but the lack of a centralized world bank or of uniform procedure on the part of all credit-issuing banks" (Chapter 20: Money and Banking; pp. 411, Section 2.2 Theory of Money & Credit).

People have often categorized gold bull markets as a rebellion of private property owners against the state, or similarly, as a brand of economic justice correcting the dislocations produced by the state's encroachments on economic freedom - through inflation as well as other means. I would agree.

Put another way, gold bull markets represent corrective forces against the cumulative impact of the State's policies (intervention into the economy) on price structures. And the biggest intervention of all, absolutely, is the relentless inflation of money. So, in light of Rothbard's claim that big business and government have displaced the market, it's no wonder gold bull markets have become bigger and bigger during the 20th century!

Whereas the state finances current consumption by deferring its costs into the future, gold bull markets make them pay, closer to now. In fact, it was the gold bull market of the seventies that motivated Rothbard's Libertarian Manifesto in 1978, in which he fervently believed that the new movement, dubbed Libertarian instead of "Liberal," began anew. It's no coincidence, for the bull market in gold it was very much about liberating commerce from the clutches of the State's monetary grab; it wasn't until the mid seventies that individuals in the United States were allowed to own gold again - after FDR abolished that sovereign property right in 1933.

Looking at the big picture, what you probably saw happen when Paul Volcker came in to power in 1978 was that the market forced the central bank into a dilemma where it would have to either dissolve, or tighten the belt itself - the market disciplined the Fed in other words. But that discipline was to be as brief as the libertarian rally.

Why is this important? Because the Fed hasn't been disciplined by the market for a long time - yet, money supplies have more than tripled since the last gold bull, allowing the government to sustain a budget & trade scheme, causing a massive decumulation of capital in the United States (exporting of industry), as well as the accumulation of imbalances related to the Fed's prolonged subsidy of uneconomic enterprises.

So what; what else is new? For one, what you've seen in gold so far is the beginning of a process that will ultimately either discipline the Fed again, or dissolve it this time around. The arguments in favor of property are a matter of justice and utilitarianism. But the case in favor of a gold bull market - meaning higher prices - is one of imploding pent up imbalances.

Both, the Fed as well as the government are making the same mistakes they made, essentially, in the twenties, and in the sixties by tinkering with the market; except this time they're doing it on an unprecedented domestic scale, and an even a wider worldwide scale if you include the role of the global banking alliance.

And it is this increasing role, over time, that I would argue is the fundamental reason for the greater and greater volatility in all prices (asset prices as well) throughout the 20th century. Let's put it this way, the larger the government gets, especially in money, the larger the gold bulls it will produce when its policies fail!

That's the essence of it. The State has not even begun to pay for the errors of its ways… it's just brushing them under a carpet of new errors. Still, why couldn't the status quo exist for another 20 years?

The Fed's Inflation Trap, Not Liquidity

Trap

Besides the fact that the status quo today just happens to be a gold bull,

the bottom line is that the tools at the Fed's disposal - the ones that

it regularly uses to hide and control its inflation with - have fallen:

- Interest rates can't be lowered much beyond 1% (to boost stock prices, and the dollar)

- The budget surplus lie has vanished from credible analyses (bad for dollar confidence)

- Stock market valuations are too rich to transmit monetary policy, or to sustain net dollar demand

- The impetus to the strong dollar policy from currency crises overseas has diminished

- The condition of the oversupply of commodities that aided dollar policy (disinflation) in the eighties and part of the nineties has reversed as the result of decades of underinvestment in these industries - due to the shifting of capital resources to the overproduction of other things (malinvestments)

- Currency interventions on the part of friendly central banks no longer work to boost confidence in the dollar, but have worked to keep its foreign exchange rate overvalued - i.e. a widening trade deficit

All these tools in one way or another normally help the Fed hide, control, and sustain its inflation. But a gold bull is characterized by a loss of confidence in the world reserve currency "as money," which means literally that it must manifest in the growth of inflation expectations - of the realization that prices will soar because the Fed is going to keep inflating no matter what, since that's what it takes to affect a demonetization (partial or whole) of the Fed's notes - I didn't say the dollar because the dollar could be anything: gold or a Fed note. In other words, a gold bull is characterized by the fact that it can no longer hide or control the impact of its inflation.

The bottom line today is that there's increasingly more inflation than productivity, and it is this that eventually begets a gold bull market when the laws of the market can no longer be bent to the will of the state, or banking cartel - which I believe is the case today.

So why don't they just stop the inflation, and regroup?

If we were on a gold standard, and the Fed inflated, the undesired inevitable result would probably be deflation (a contraction in money) because under a gold standard bank reserves are the public's gold deposits. So a financial panic would cause people to have enough consternation about the solvency of the initiators (their banks) that they'd withdraw part or all of their gold depending on the severity of the crisis. This is deflation. Under a gold standard, this is how inflation is halted in other words.

Deflation is not when prices fall because capitalism produces things cheaper. It's when the supply of money contracts, and if the reserves of banks are gold, a withdrawal of gold is going to cause them to call in all their outstanding loans, which means the monetary contraction reverberates through the economy (prices) - since the Fed cannot make gold (so far?). But today, reserves can easily be made because they themselves are nothing but paper, which is why we argue, that instead of the consequence of inflation being deflation as was the case in the thirties, in the post gold standard era it manifests as a currency crisis of immense magnitude.

The threat of a bank run could hardly be imagined today because why bother withdrawing cash that's devaluing anyway; it's not like anyone would be exchanging their devaluation prone notes for hard bullion - they'd just be exchanging notes for notes, and the Fed stands ready to produce as many as "needed."

As we've argued recently, moreover, higher rates themselves aren't likely to stop inflation so long as they do not rise to where they would be if the Fed didn't exist to keep them below that theoretical level in order to persuade the growth of money supply; yet the more inflation that is produced and "perceived," the higher this level will be also, so that eventually, rates are going to have to go to the moon to stop this thing… as they did in 1980.

Thus, I expect the status quo bull market in gold to continue until that day.

What's important to note - as regards this hypothesis - is that in the post gold standard era, inflation ends when the market pushes interest rates well above market, or temporarily when it inverts the yield curve, not merely when they go up. I think it's an error to assume that the "gold" boom is vulnerable to even the slightest uptick in rates - certainly, the economy is; but that's just it - the economic boom is artificial, weak, and tentative.

But this is the source of the Fed's inflation trap; it's embodied in the value of stock prices.

My view is that any uptick in (market) rates on the realization of these things or otherwise would simply fuel a bear market in stocks that would unravel the still way overvalued currency, which in turn would fuel the price revolution in dollars, higher interest rates, and so on in a reinforcing dynamic until the bear markets in stocks and the dollar have completed. Hence, even if the Fed wanted to abandon the inflation today, with stock values where they are it is likely to cause a crisis of confidence in the dollar on foreign exchange markets first.

Ergo, it is NOT inflating to prevent deflation.

To the extent its inflation is aimed at stabilizing the economy, hah, the outcome it is really trying to postpone is a collapse in the reserve currency. I'd even argue that it would prefer deflation to that (creditors tend to think they can win). So until stocks have been beaten to a pulp, the Fed cannot afford to abandon its inflationary position.

It is trapped in its current inflationary quagmire by virtue of the fact, not that it is afraid of deflation, but rather that it fears a currency crisis and subsequent blame, which could only empower the abolitionists.

There are two main reasons inflation exists: 1) to help governments exculpate their policy sins, and 2) because some classes wish to redistribute your wealth. It's that simple, and so is their ultimate payment - a collapse in this corrupt institution, and what many call hyperinflation, but which would be a demonetization of the Fed note.

Those are the chief reasons for inflation. If you study the process the realization sets in that there are probably policies that can better perform the 2nd function, such as taxation.

However, taxation has two draw backs:

- It requires consent, and

- The banks couldn't get their piece of the pie

In conclusion, as gold bulls there are two ways in which we can deal with the arguments that the Fed exists to fight deflation, or that gold will go up if we get deflation even if everything else falls in price. With a grin, or frankly. I owe it to you to be as frank as possible, but sometimes, I just wish I could sit back and grin.

I hope that didn't sound arrogant. Now, back to the business at hand…

USd Technicals, News Deteriorate Further

The news last week was absorbed in corporate malfeasance trials, political

malfeasance tribulations, topped off with a wave of "surprise" profit

warnings from the tech sector, as well as new information about a potential

terrorist attack on US soil. GE's head honcho came to the bulls' rescue

on Friday though with a tout on the economy after reporting what most

analysts called bullish earnings for the second quarter:

Jeff Immelt, chairman and chief executive of the world's largest company by market capitalization, called the economy the best he has seen "in years." Many economists were quick to back GE's view. And even the more temperate market observers had a hard time debating Immelt's unequivocal statement. "Absolutely," said Gail Fosler, chief economist for The Conference Board, when asked if she agreed with Immelt. "The industrial sector, which is very important to him, is growing at about 8 percent to 10 percent a year. So it's the best it's been in about 20 years" - CNBC

On the political side, the US administration said last week that it had new grounds to suspect that the Al Qaeda network is planning ("from hideouts suspected to be along the Afghanistan-Pakistan border") an attack on US soil sometime this year, before the election.

"…senior administration official said on Thursday that the intelligence reports - apparently drawn partly from interviews with captured Qaeda members and partly from other intelligence - referred to efforts "to inflict catastrophic effects" before the election. This official said that the reports did not refer specifically to Mr. bin Laden's instructions or desires, but did make clear that instructions were coming from Qaeda leaders" - NY Times

Little

changed in global bond markets however over the course of the week except

that they were buoyed by the Safehaven premium, the prior week's FOMC,

Bill Gross' bullish posture (which was a bet made prior to the FOMC that

it wouldn't raise much), weaker stock prices, and disappointing economic

data. All in all, the events weighed on the US dollar - which weakened

mostly against the Aussie, Rand, and Euro last week.

Little

changed in global bond markets however over the course of the week except

that they were buoyed by the Safehaven premium, the prior week's FOMC,

Bill Gross' bullish posture (which was a bet made prior to the FOMC that

it wouldn't raise much), weaker stock prices, and disappointing economic

data. All in all, the events weighed on the US dollar - which weakened

mostly against the Aussie, Rand, and Euro last week.

Technically,

the US dollar index extended a downtrend that began late May after the

bulls failed to follow through above the 200-day moving average.

Technically,

the US dollar index extended a downtrend that began late May after the

bulls failed to follow through above the 200-day moving average.

It's possible that right now the market is, or soon will be, viewing it as a failed reversal attempt by the bulls. On the other hand, in light of the overwhelming bullish sentiment it might be viewed as a test of February's "bottom" at least until bears push through to a lower low… like the correction in stock prices is seen as just that so far, and nothing more.

Confirming

the dollar weakness is the fact that all of the major currencies are back

above their 200-day moving averages except for the Aussie, though last

week's performance was encouraging there too. The Swiss Franc is a hair

away from making new eight year highs.

Confirming

the dollar weakness is the fact that all of the major currencies are back

above their 200-day moving averages except for the Aussie, though last

week's performance was encouraging there too. The Swiss Franc is a hair

away from making new eight year highs.

The message gold and bond traders should be hearing is that weak stock prices are bearish for the dollar; and stock prices have a long way to fall. Gold traders have long known it already… perhaps we could even say that's what we know that nobody else seems to yet, in part probably because last year's bear market rally helped people forget. In fact, gold traders know it so well I wouldn't be surprised that the rally currently underway reflects basically the anticipation of an accident on Wall Street as well as the dollar.

A quick run up to $430 gold would confirm my convictions.

COT's Reveal Bullish Underlying Structure

Volume was by no means light on the COMEX floor even if it is summer.

August gold traded 77,000 contracts on Thursday's pop to a higher high in the gold price sequence that started in May - that's more volume than it traded on any day during the rollover and reversal in late May too, and as much as it has traded at any time since March. The same comments apply to silver trade.

The activity was certainly not light, which bodes well for this move.

Little has changed in structure since the late May rally, according to the CFTC COT report up to July 6th. Total open interest is down a little; some of the funds switched from short to long, and the commercials have reduced some of their longs a little as well. But these changes have been mild. The most vivid change occurred in the halving of the smaller non-reportable short positions (the odd-lotters if you will).

In the bottom graph (below) you can see that during the current cycle, the strongest rallies in gold prices (1st half 2002 and 2nd half 2003) were preceded by a liquidation in small (non-reportable) long positions and a spike in their shorting activity, but also, that the small speculators haven't returned to this market since the liquidation during the 1st quarter 2003 despite the subsequent rally to new highs - some returned at the very last inning.

The statistics in the graphs on the next page are in proportion to the total outstanding open interest (all contracts) for gold at COMEX. Some observations in case you don't notice them yourself include:

- The liquidation in the commercial short position in May was the most significant one since the pre-2002 gold price rally, while the net short position fell to its lowest since August 2002, and December 2001

- There has been an increase in commercial long interest ahead of every rally to date - they tend to buy the corrections almost mechanistically

- The funds have been increasing their shorting activities since last summer; they are shorter than they've been since before the whole thing began in 2001, and they are at their lowest net long position in almost two years. On the long side the funds (reportable speculative positions) have been all over the place but it's not a bad sign that they've just recently liquidated

- The net long positions held by small (non-reportable) traders are at their lowest since December 2001

The structure of this market looks good on these grounds alone.

The COT's aren't the best indicators for this market but at least they reveal bearish sentiment dominating the speculative trade, and bullish sentiment dominating professional trade; it could be better, to be sure, but not much. Undoubtedly last week's move changed that a bit also.

My guess is that the funds are going to start coming back, especially if we're right about the dollar, and that new highs will bring in the odd-lotters that'll set up the next top… at $500?

Gold Bulls Eat Through Resistance, Charts

Look Good

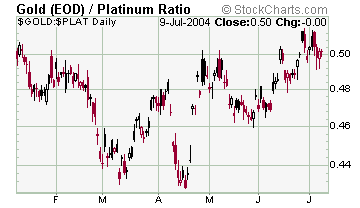

Although gold outperformed the currencies, the Dow, and the CRB last week,

it still took a back seat to the stellar gains made in silver (+8%), oil

(+4%), and platinum (+4%) prices.

Silver

broke out of a two month bottom in a sharp rally that'll probably take

it to $7 in the near term, if only to fill the gap as they say (I don't

buy that stuff though - my target is based on the size of the May/June

bottom). Nevertheless, both gold and silver are generally leading the

other metals higher.

Silver

broke out of a two month bottom in a sharp rally that'll probably take

it to $7 in the near term, if only to fill the gap as they say (I don't

buy that stuff though - my target is based on the size of the May/June

bottom). Nevertheless, both gold and silver are generally leading the

other metals higher.

In other commodity markets, lumber prices appear to be breaking out of a declining wedge, oil bulls ended their June correction, and gas prices have charged up to new all time highs.

Many

of the food stuffs (OJ, Sugar, Hogs, and the Cattle markets) are in the

grips of a strong intermediate bullish sequence.

Many

of the food stuffs (OJ, Sugar, Hogs, and the Cattle markets) are in the

grips of a strong intermediate bullish sequence.

Although the CRB has been weighed down by the metals and the grains recently, all in all the commodities have been looking up again, as would be expected in this environment.

As we've shown (last week), gold bulls have been bouncing off of the long term trend line (not the 200-day MA). But they have also recovered the 200-day moving average, blown away the neckline of the bears' double top hypothesis (at between $390 and $400) and now, after chewing through all of that resistance, they've extended a short term bullish sequence on momentum that looks destined for last December's highs at least.

'Tis the season and we're due for a win.

Calling on New Suitors - IAG, GSS, GOLD

IAMgold let loose last week to lead the sector with an 18 percent advance

after shareholders rejected the unhappily priced Wheaton deal. Golden

Star - who has also made a bid - now stands a better chance, but I think

Randgold should take a run at IAMgold if only to protect its dominant

position in Mali.

Randgold's production is in Mali and Golden Star's production is in Ghana. However, Iamgold's production (and reserves) is split between both regions.

At the moment, both Randgold and Golden Star are in about the same league, but an acquisition of IAG would put one significantly ahead of the other.

So strategically it makes sense for Randgold to step up to bat if Golden Star has got a shot. We liked Iamgold but the Wheaton deal capped its share price and kept us out. The subsequent move in IAG's share price (last week) was too much too fast and makes the stock a little rich for my blood. But in any case, I think a combination with either one of the two companies above would create more synergy than the Wheaton merger could, in my opinion. We just happen to own Randgold. So Iamgold might be a good buy for aggressive investors betting on a potential bidding war.

Gold Share Internals Look Up… Our Favorite

Bets and a Word of Caution

Barrick, Iamgold, Pan American Silver, and Cambior pushed above their

200-day moving averages last week joining the stalwarts in the sector

- Glamis, Agnico Eagle, Meridian, Placer, Wheaton, and Silver Standard.

The

silver surge caused strong gains in the silver share complex except Coeur

d'Alene was left out. Running close behind Iamgold and the silver stocks

last week were, respectively, Cambior, Meridian, Agnico Eagle, Freeport,

and Newmont who got a tout in Barron's last Monday. Among the worst performers

besides Coeur were the South Africans, as well as Bema, Placer, and Glamis

(the rankings in the table above are for one month rather than one

week).

The

silver surge caused strong gains in the silver share complex except Coeur

d'Alene was left out. Running close behind Iamgold and the silver stocks

last week were, respectively, Cambior, Meridian, Agnico Eagle, Freeport,

and Newmont who got a tout in Barron's last Monday. Among the worst performers

besides Coeur were the South Africans, as well as Bema, Placer, and Glamis

(the rankings in the table above are for one month rather than one

week).

Excepting Bema, I would categorize all of the above mentioned shares as having better than the average chart - better than the averages themselves at any rate. I also like Goldcorp's action here, as well as Randgold's, and especially Meridian's.

Caution:

I'm very bullish on the sector for the moment, but my outlook for the

next 12 months is a generally choppy and volatile market for the gold

shares in particular. It is typical that during primary gold share liquidations,

gold stocks can easily give up more than half of their values. While we've

argued that the latest correction does not constitute the beginning of

such a liquidation, to the extent that we're right, the primary liquidation

must still be ahead of us then.

Caution:

I'm very bullish on the sector for the moment, but my outlook for the

next 12 months is a generally choppy and volatile market for the gold

shares in particular. It is typical that during primary gold share liquidations,

gold stocks can easily give up more than half of their values. While we've

argued that the latest correction does not constitute the beginning of

such a liquidation, to the extent that we're right, the primary liquidation

must still be ahead of us then.

The question is how much ahead?

I

believe it will start when gold has reached our target ($475-$500) on

account that this move will represent the end of the current primary sequence

that began in 2001 - based on technical premises which I'll discuss later.

I

believe it will start when gold has reached our target ($475-$500) on

account that this move will represent the end of the current primary sequence

that began in 2001 - based on technical premises which I'll discuss later.

The easiest trade today, in my books, is to be long gold and short the Dow & USd… regardless of whether that turns out to be right or wrong in the short term it is absolutely right beyond that. Gold shares are the next best long bet I feel, and following that I would say a short bet against the bond market is a good position to hold.

For investors that only trade stocks, perhaps one way to hedge their gold share longs would be to take a position in the Prudent Bear fund (BEARX), which is due for a rally. But that's only good for US investors since it's denominated in US dollars; foreign investors would have to bear the dollar's fall or find a local bearish bet.

The focus over the next week is going to be earnings, geopolitics, domestic politics, and malfeasance. The economic news includes May's trade data, June's budget figures, and the PPI/CPI is due later in the week. Consensus expectations for these data are benign, which may play out due to the correction in commodity prices during June. I don't know. We'll see. But I doubt they'll be all that bullish for the dollar at any rate, unless undue weight is placed on the near term corrections.

One final aphorism:

When people say that money is the "root of all evil," what they're saying, effectively, is that freedom is the root of all evil - because money is that thing which sprouts up under a system of voluntary exchange (capitalism); it's the object of your freedom, as well as its instrument.

Capitalism and freedom are intimately tied.

The Austrians claim that the opponents of freedom choose to attack capitalism over its parent doctrine on account that it is easier to drum up anticapitalist rhetoric than antifreedom or antiliberty sentiment. In a system that relies on the forced and constant expansion of money supplies, it is only natural that capitalism will receive blame because money is its medium. However, there is nothing in the market nature of money that requires it to expand in quantity at all - that is completely the aim of a minority of people in government and banking circles, and the consequences should too be theirs.

P.O. Box 4642

V.M.P.O.

Vancouver, BC

Canada

V6B 4A1

Phone: 1-604-876-7037