|

Friday

was a fabulous day for the gold sector even if gold prices didn't

participate much themselves, yet. Friday

was a fabulous day for the gold sector even if gold prices didn't

participate much themselves, yet.

Gold stocks had their best one day

gain since December. They closed up on the day about as much as

they did on the week - to illustrate how sluggish trade has been.

The AMEX Gold bugs index surged almost 8% Friday. But it still was

runner up to the S&P gold sector index, which was up 8.3% on

the day.

Shares of Durban, Glamis, Goldcorp,

IAMGold, Goldenstar, and Hecla Mining were up more than 10%. Anglogold

and Newmont were both up better than 8%. Anglo and Newmont are the

world's two largest gold miners if you weren't already aware of

it.

To be sure, gold and the main gold

sector averages still have resistance to contend with - 125 to 135

in the HUI, and $335 to $360 for gold - even if the longer term

trends are intact. However,

the rally in gold shares looked bullish, and may underscore our

outlook, that the worst is

behind for this sector. I get particularly excited, from a technical

point of view, when gold shares trade as strongly as they did on

Friday, just when the Dow is turning down. Gold shares tend to be

a leading argument you see, at least at the healthier stages of

a gold bull.

Newmont

released its quarter and year end numbers Friday morning. They were

held up due to a difference of opinion between the company and the

SEC over the accounting for its recent acquisitions. Nevertheless,

buried in the quarterly report was news with

bullish implications. I think it was the catalyst for Friday's move. Newmont

released its quarter and year end numbers Friday morning. They were

held up due to a difference of opinion between the company and the

SEC over the accounting for its recent acquisitions. Nevertheless,

buried in the quarterly report was news with

bullish implications. I think it was the catalyst for Friday's move.

The results came on Friday. Earnings

were $0.42 cents per share, compared to a loss of 28 cents in 2001.

The news was better than expected. There were criticisms that the

fourth quarter numbers looked better than normal because of the

restatement of earnings in the first nine months, and the 6 cent

per share tax benefit in Q4. But the full year figures largely excluded

the impact of the adjustment. And there was no tax benefit for the

full year.

However, that's not the exciting

news we're talking about.

The gold sector took off after Newmont's

release, which came before the bell. Only later did the press begin

to notice that Newmont updated the status of its hedgebook as of

March 26, 2003.

| Excerpt from Newmont's Quarterly Report:

As of March 26, 2003, the company had

repurchased 804,000 committed ounces and delivered 449,000 committed

ounces for the year, reducing its committed hedge position to

3.9 million ounces. Newmont will continue to evaluate opportunities

to further deliver into, close out and simplify these gold hedge

books - March 28, 2003 |

Newmont announced it had bought back

804,000 committed ounces and delivered 449,000 ounces of hedges

in the first quarter up to last Tuesday, over and above the 500,000

ounces covered in the fourth quarter 2002 - see the text in the

box to the right. What does it mean?

In a recent issue we showed clearly

that the hedged gold producers weren't achieving full share valuations.

In particular, we showed how Newmont's share values have sunk to

a discount vis-à-vis their fair market values since the third

quarter of last year, while the other (unhedged) producers continued

to command a premium. In other words, the market began pricing a

risk premium similar to what we uncovered to be the case in all

the other hedged producers' shares.

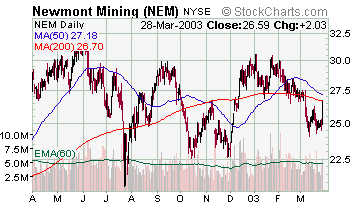

Note in Chart 1 that Newmont's shares

traded persistently near par - to our valuation estimates - until

about the third quarter of last year when they traded at an increasing

discount. This wasn't the case with the unhedged producers, which

continue to trade at or above par (par is our theoretical fair market

value), on average.

But

it certainly is the case that the hedged producers, almost regardless

of the size of their relative hedges are being endowed a higher

risk premium because of them. But

it certainly is the case that the hedged producers, almost regardless

of the size of their relative hedges are being endowed a higher

risk premium because of them.

In our small sample of producers,

the average hedged producer trades at

an (unweighted) average 67% "discount" to the value

of its reserves (proven & probable) per share, and a 34% discount

to our estimates of a theoretical fair market value - see chart

2 below for an illustration, and for some of our fair market value

assumptions at the bottom.

By contrast, the average unhedged

producer has generally continued to trade at or above par, and is

currently trading at a 7 percent

"premium" to the value of its reserves per share,

as well as a 24% premium to our estimate of fair market value

(our sample included Barrick, Agnico Eagle, Anglogold, Goldcorp,

Glamis, Kinross, Meridian, and Newmont).

Effectively, the market began pricing

Newmont like a hedger, which makes sense since it only became one

late in 2001. At any rate, we estimate (from reviewing the quarterly

reports) that last year the company delivered 1.16 million ounces

of gold into its hedge book, allowed options to expire on about

270,000 ounces, and bought back 520,000 ounces worth of hedges.

The result was that its committed net gold hedge fell from 7.1 million

ounces to 5.15 million ounces by the end of 2002. Are you still

following...

After unwinding another 1.25 million

ounces worth of hedges in the first quarter, the net committed gold

hedge stands at 3.9 million ounces. 800,000 ounces of that position

was bought back outright for $25 million. That's almost twice what

they bought back in all of 2002 - over and above what was delivered

or had expired. In a question period during its conference call

on Friday, Newmont said the hedges it was unwinding were non-Yandal

related.

The Yandal operations are part of

the Normandy acquisition. The company says that the hedge book liability

is non-recourse to Newmont, and is still generating a positive cash

flow at any rate. There was

talk about some of the counterparties

exercising a "right to break" option on the Yandal-related

hedges, but to us it only indicates

the creditors must be uncomfortable about the future price of gold.

You can see that Newmont has stepped

up its hedge liquidation plan, which might boost the market's confidence

in its "no-hedging" philosophy posted throughout each

public report.

Provided you're bullish on gold,

the upshot of it is Newmont's stock probably has upside over and

above its leverage to gold prices - stemming from the market effect

of the unwinding of the derivative-risk premium - so long as the

market's confidence continues to increase in its no hedge philosophy.

But the news is even more bullish

for the gold sector if it's a bull market; as you can see in chart

2 above, the hedgers paying attention to their share values must

notice as you do that they can achieve fuller market valuations

by ridding themselves of their hedges simply by looking at their

competition.

In

Newmont's case (this is not a prediction), if we're right about

the above hypothesis, the stock could trade back up to $30 per share

- even assuming gold prices, or the outlook for gold prices, don't

change. But then, if the implications for gold weren't obvious before,

they are now: Newmont is a believer in the bull market. In

Newmont's case (this is not a prediction), if we're right about

the above hypothesis, the stock could trade back up to $30 per share

- even assuming gold prices, or the outlook for gold prices, don't

change. But then, if the implications for gold weren't obvious before,

they are now: Newmont is a believer in the bull market.

Cautionary note: this

is neither a forecast nor analysis of Newmont. It is an analysis

of the implications for the gold sector. There are other factors

to consider for an investment in Newmont shares. Operating Engineer's

Local Union No 3 in Elko County Nevada went on a two day strike

over pay and safety issues with the company for instance. They've

since gone back to work last we heard, but the situation bears

watching. Moreover, Mineweb reports that Newmont still has to

write down some goodwill, which will lead to a higher debt to

equity ratio, and might result in an equity issue towards yearend.

Though, the verdict on that is out, because Newmont explains that

the goodwill is actually a new category of asset - not quite reserves

and not quite an intangible - as a response to changing

SEC regulations.

Also obvious by chart 2 above is

that both Anglo and Kinross (despite Kinross' relatively small hedge)

have at least as much to gain from a hedge liquidation as Newmont

does.

Barrick wasn't included in chart

2, but it's trading at around the average. Were

Barrick able to liquidate a large quantity of its hedges this year,

it would have enormously bullish implications for its own share

values, since they also may have a hate premium attached. That's

the message here folks.

Newmont's announcement may mark the

beginning of another phase of this bull market, where the attitudes

of all the (hedged) producers shift from delaying, to acting decisively.

After all, for two years now the market has made increasingly clear

the incentives for making that decision. And that could slap the

Cabal right in the face. In a gold bull market, I believe we will

soon see, the cabal is irrelevant!

The comeback

in gold stocks Friday is in no small way related to these developments.

But so too has the war premium stopped

deflating - or at least traders have realized it's hard to make

money trading it. And the US dollar can't find traction, despite

about a 20% correction in gold prices. Now, at the opening bell

Monday morning, S&P futures are off 14 points.

Another bullish factor could be that

the speculative froth - from the January run up to $390 - has largely

been weeded out now. Andy Smith (precious metals analyst), for instance,

called on a big gold bear last week, so maybe we've shaken out the

weak hands...

Smith makes the typically boring

bearish argument that the central banks simply want to sell all

their gold, but have decided to mercifully subsidize the producers

who apparently had lobbied the central banking community for the

Washington Agreement in 1999 (good through 2004) - restricting the

central bank selling of gold to tranches instead of all at once.

Uh, huh. Subsidizing producers? Which

ones? Do the central banks have favorites? Because some of the ones

Smith's thinking would apply to are getting strangled by their hedges.

And what of the bankers that have all their interest rate derivatives

fixed to benefit from a low interest rate environment? How are the

central banks subsidizing them? The main group benefiting from rising

gold prices are the unhedged gold producers, and their shareholders.

Should the central banks continue

"subsidizing" this group, then, they risk problems at

some of the larger producers, as well as the bullion bankers vulnerable

to the impact from higher gold prices and therefore interest rates.

Sorry, we have to reject Smith's theory on grounds, well, that it

sounds stupid. It involves an institution subsidizing a relatively

small sector at the expense of the main sector it is trying to protect?

Let's stop wasting our time and consider

the other side of the coin.

Putting aside the obvious issue of

deliberate gold price manipulation, and disinformation, or not,

here's another possibility.

The Washington Agreement was put

in place to keep central banks - and other players taking their

lead - from liquidating their gold too quickly, or from getting

the wrong signal from the Bank of England's announcement in the

spring of 1999 to liquidate the remainder of its own gold reserves.

That doesn't mean producers weren't

lobbying for it to happen. It just means that's why the central

banks agreed to it.

It's not a matter of whether gold

is a good asset. We already know it's not an asset. It's money -

in the economic sense, rather than the physical or legal sense.

In fact, it's because gold has no

intrinsic value as an asset, or capital good, that it is

ideally suited to the task. It's simply the commodity most treasured

by the consumer, and in a free market environment where government's

intervene and devalue their currencies for political gain, due to

its unique monetary characteristics, it is a terrific barometer

of the dollar's value also.

But I suppose it doesn't matter how

many times we superimpose an upside down gold chart over the dollar

(index) chart, in order to highlight this relationship. Smith and

other bears argue that a technology revolution combined with the

perfection in central banking policy over the years has made the

dollar invincible. What can we say to that, except hogwash.

Gold moves forecast movements in

the dollar. They have for as long as the charts go back, but for

a few exceptions. They also tend to lead commodities, and ever since

the mid seventies gold has maintained its lead on commodities even

if the premium has come down somewhat through the past 20 years.

Note the long term trend below.

The United States has had two major

dollar devaluations in the 20th century. The first was after the

1929 stock market crash, and the second came after the Nifty Fifty

(tech stock bubble) crashed in the late sixties / early seventies.

The dollar's value was rigged in both instances, so the subsequent

results were rather extreme (imbalances pent up). Guess how they

were rigged in both cases? The US government had a mandate to fix

gold prices. Actually, it was to fix the dollar, but the inference

is clear. It was done by manipulating gold.

Consequently, the imbalances accumulated

until in 1934 FDR had no choice but to confiscate the right to own

gold, and in the 1969 period, the London Gold pool was disbanded.

Andy Smith would like us to believe

we live in a world where central bank professionalism and technology

have made gold irrelevant. But the reality is we live in a world

where profuse inflation policies (or bubble economics) lead - time

and again - first to an overvalued dollar, then to dollar devaluation.

Smith says Greenspan and co. have

created the ideal money for the capitalist system to thrive. We

argue corrupt monetary policies have undermined that process, and

strain it every day.

Smith works for the establishment.

But he couldn't tell money from cow poop.

The technology revolution is bullish

for gold, because it will uncover the lies, the nonsense, and the

deceit. All of them, one by one.

However, one mustn't forget that

it's a two way street. Technology has empowered the market, but

it has also empowered the market's enemies. The gold bull market

is destined to drag out until the truth in matters of money has

amassed critical momentum, and the economy has healed itself of

the malinvestments that plague it.

But let this truth stand no opposition.

Twentieth century monetary policies have "driven" gold

demand (and values) like no other century ever has. Let the central

banks sell their remaining piddly gold reserves into that ongoing

fact.

Edmond J. Bugos

|